Mind Over Matter

Behavioural finance is certainly not without its drawbacks, nor its critics.

This, however, is only to be expected with a science that was only conceived approximately 50 years ago. Yes, psychology was already being developed by Aristotle, and certain principles of economics are as old as money itself, but the interdisciplinary approach and attempt to marry the two fields is what’s novel.

Daniel Kahneman, author of the newly released Thinking, Fast and Slow, is considered to be the grandfather of behavioural finance. His academic and theoretical arch nemesis: Gerd Gigerenzer, author of Risk Savvy, and Director of the Centre for Cognition and Adaptive Behaviour at the Max Planck Institute in Berlin, Germany, is his most renowned critic who won’t leave any of Kahneman’s publications unchallenged.

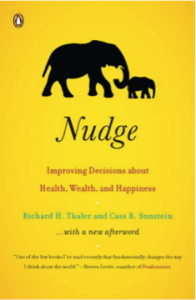

The most recent debacle in 2014 was thoroughly commented on by Tim Adams of the Guardian (http://www.theguardian.com/science/2014/jun/01/nudge-economics-freakonomics-daniel-kahneman-debunked). In brief, Adams attests to David Cameron’s recent political races, and how Richard Thaler and Cass Sunstein – both companions of Kahneman, co-authors of Nudge and Freakonomics, and temporary advisers to Prime Minister Cameron – proposed a strategy to Cameron, which not only led him to seek out new economic advisers, but which only produced 1% of the originally desired result.

Again, the science as an interdisciplinary approach is young, and oftentimes, behavioural finance is dealing with two very distinct levels: social, and personal.

We are social beings by nature, and collective behaviour will influence our decisions to a certain degree. As I mentioned in my previous post, the aggressiveness and amount of bidders seeking to buy the same thing we want will often lead us to overshoot the correct price. The challenge – as demonstrated by Thaler and Sunstein’s unsuccessful political endeavour – is to accurately predict how collective behaviour will influence societies on a macro level.

More to be seen on behavioral finance on the social, macro scale, in later posts!

Let’s briefly turn to what I would like to call the personal, micro scale.

Jason Voss, CFA, of the CFA Institute, recently wrote about how and why he likes to meditate (http://blogs.cfainstitute.org/investor/2014/12/12/best-of-2014-behavioral-finance-economics-fixed-income-meditation-and-more/). ‘Mindfulness’ has certainly soared in popularity in our modern day and age because of its usefulness in improving creativity and insight, and altering one’s own ethical makeup, but most of all, in decreasing stress. The human mind has that extraordinary capacity to rise to different heights, beyond the everyday and mundane, which is where most get trapped. In his article, Voss is referring especially to the sunk-cost bias, which “occurs when your investment, financial or emotional, is so large that you refuse to change your mind or shift directions. It may feel nearly impossible to stop investing due to hopes of recovering funds as well as the need to save face and a fear of failure.” (Cf. http://www.inc.com/marla-tabaka/how-to-make-smarter-decisions-in-just-15-minutes-a-day.html).

Unlike Sunstein and Thaler’s outcomes, the measurable results from mindfulness practices has led companies like Google, Aetna Health Insurance and General Mills to invest in facilities and personnel that provide space and time for reflection, meditation, yoga, and other mind-calming activities.

It is precisely in rising to our speculative, reflective thinking capacities that allows us to change and modify our behaviour, which consequently leads us to change the way we spend money.

If you want to beat the market, it all starts in your head.